does workers comp deduct taxes

On This Page. However if you resume work for any amount of time including on light duty you will.

How To Deduct Workers Compensation From Federal Tax Form 1040

Since workers compensation is considered necessary by law it is also a.

. No in most cases. IRS Publication 907 reads as follows. 6 Employees of your small business on the other hand dont pay anything for workers comp so.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. Does Workers Comp Count as Income. Workers compensation settlements and weekly payments are not subject to income taxes.

The short answer is no they are not taxable. Workers Comp is Generally Not Taxable. Opry Mills Breakfast Restaurants.

Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards. Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. While the income is offset with a deduction before the taxable income amount is.

In the eyes of the IRS workers compensation insurance is. Compensation from workers comp earned from occupational injuries or illnesses is fully tax-exempt provided the insurance carrier adheres to state workers compensation. The answer is no.

In most cases they wont pay taxes on workers comp benefits. These are tax exempt benefits with only rare exceptions. Workers Compensation and Taxes Generally temporary benefits are considered to be earnings.

Any business would then consider a workers compensation insurance policy to be a normal business expense. Your workers compensation benefits over an entire tax year will remain non-taxable. Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable.

From IRSs Publication 525. In the eyes of the IRS workers compensation insurance is typically tax-deductible. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. Sales Tax Reno Nv 2021. Mandarin Chinese Restaurant Lahore.

Workers compensation benefits are not normally considered taxable income at the state or federal level. Tax Liability from Combined Disability Income. The lone exception arises when an individual also receives disability benefits.

The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word. Mandatory workers compensation insurance is normally withheld for employees not independent contractors but the law is a state law and is different in every state. And wages are subject to the usual payroll taxes and other deductions like health insurance and union dues.

Does Workers Comp Deduct Taxes. Does Workers Comp Deduct Taxes. But they are still wages.

However business owners can deduct their workers. Whether you have received weekly payments or a lump. If you are not receiving Social Security Disability benefits your workers comp will generally not be counted as taxable.

Usually workers compensation benefits will not affect your tax return. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes. Tax Liability for Lump-Sum Settlements.

As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your income when filing your tax returns. Youll want to make sure to keep track of your premium payments and include them at tax time. There is a caveat however.

Up to 25 cash back If youre eligible for temporary disability payments or permanent disability benefits through workers compensation those benefits are generally tax-free at the state and. Do you claim workers comp on taxes the answer is no. Restaurants In Matthews Nc That Deliver.

The quick answer is that generally workers compensation benefits are not taxable.

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

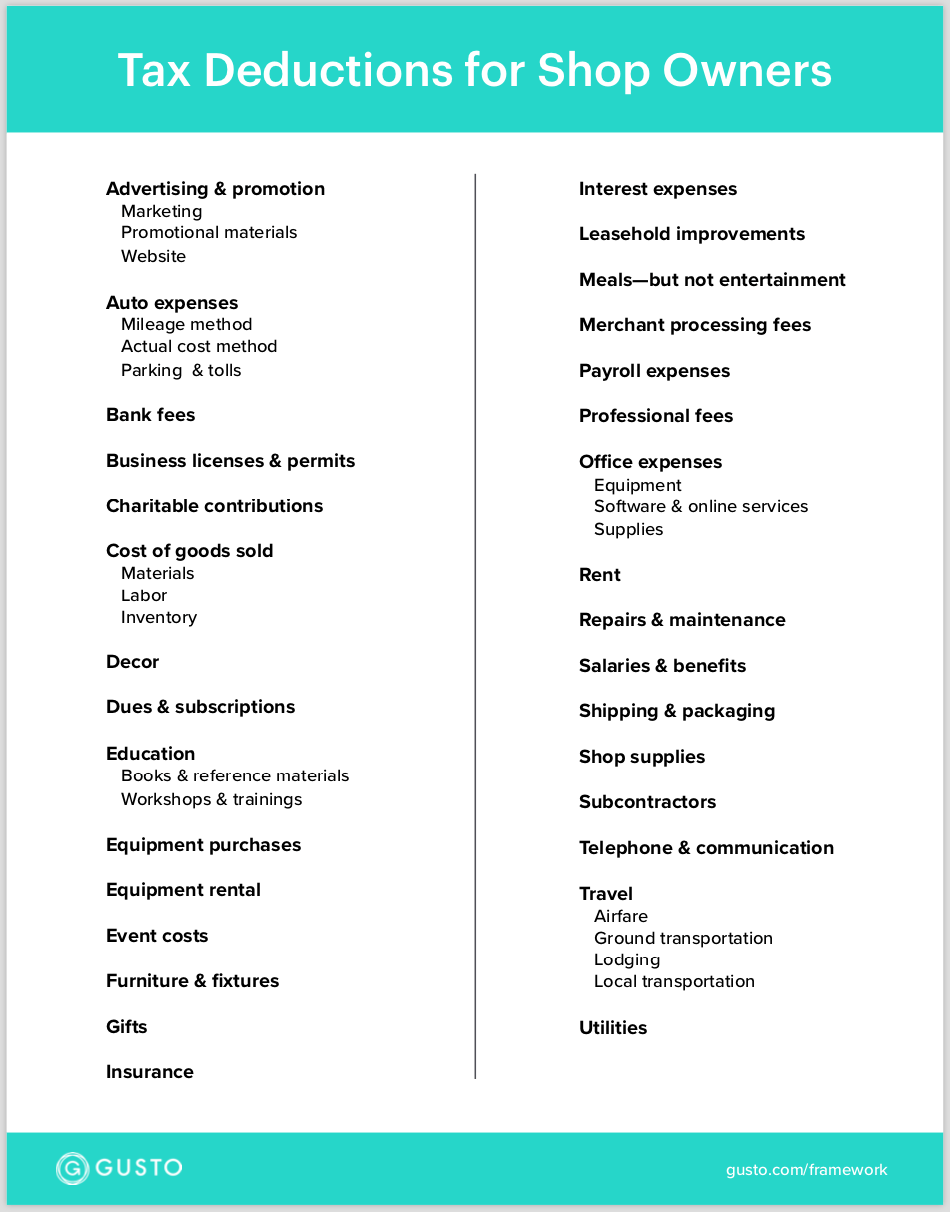

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

25 Small Business Tax Deductions You Should Know About Hourly Inc

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Calculating How Much Your Workers Compensation Claim Is Worth Steinger Greene Feiner

What Wages Are Subject To Workers Comp Hourly Inc

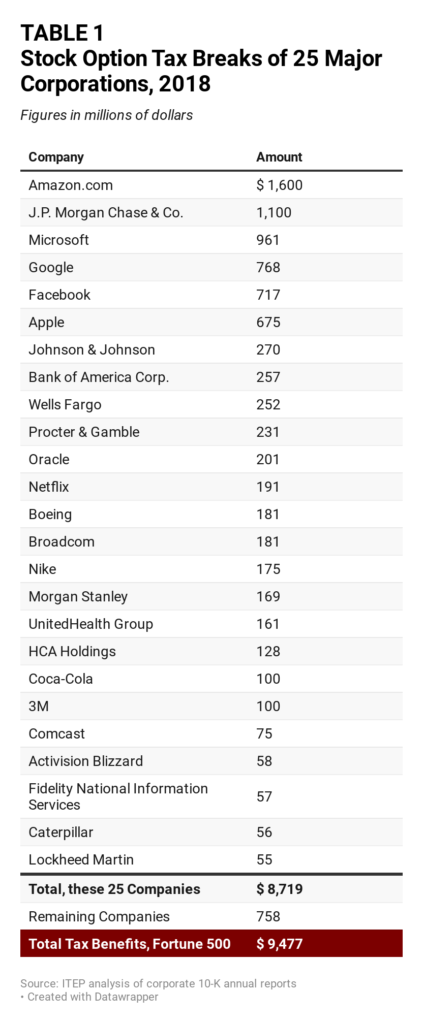

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Fica Taxes Unemployment Insurance Workers Comp For Owners

Different Types Of Payroll Deductions Gusto

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable Workers Comp Taxes

101 Tax Write Offs For Business What To Claim On Taxes Small Business Tax Deductions Business Tax Deductions Tax Write Offs

2022 Tax Day Got Scammed You Can No Longer Write It Off On Your Taxes Abc7 San Francisco

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto